Acting on climate change mitigation is essential for FMCG companies, as they have the capacity to accelerate the transition towards a sustainable economy. Global professionals agree that climate change will have a direct impact on their businesses, according to Euromonitor International’s Voice of the Industry: Sustainability Survey, fielded January 2022, (n=588), as 76% think it will affect consumer demand, while 71% mentioned supply chain disruptions. Additionally, increasing pressure from stakeholders is pushing corporates to demonstrate commitment through traceable and transparent actions. Therefore, properly implemented net zero strategies will remain necessary.

What is a net zero strategy and why is it important?

Net zero is the capacity to balance the greenhouse gases (GhG) going into the atmosphere by cutting and removing carbon emissions.

As the Intergovernmental Panel on Climate Change (IPCC)'s latest report states, there is still time to limit the global temperature increase below 1.5C, in line with the Paris Agreement’s most ambitious trajectory. However, significant efforts are still needed to accelerate this transition as experts estimate that by 2030, global net emissions will need to be 48% lower against a 2019 baseline for a 1.5C scenario.

Therefore, it is imperative that companies develop strong net zero carbon strategies by considering their entire supply chain, including three types of emissions:

- Scope 1: All direct emissions from owned or controlled sources, like fleet vehicles.

- Scope 2: Indirect emissions from electricity purchased and used by the organisation.

- Scope 3: All other indirect emissions from upstream or downstream activities.

In essence, to be effective and relevant, it is important that companies align their net zero strategies as close as possible to international standards and metrics, so they demonstrate commitment through accountable and transparent actions. For instance, many multinationals, such as Coca-Cola, PepsiCo, Procter & Gamble and Pfizer, are committed to the Science Based Targets (SBTIs) to reduce emissions in line with the Paris Agreement goals.

Now is the time to be proactive

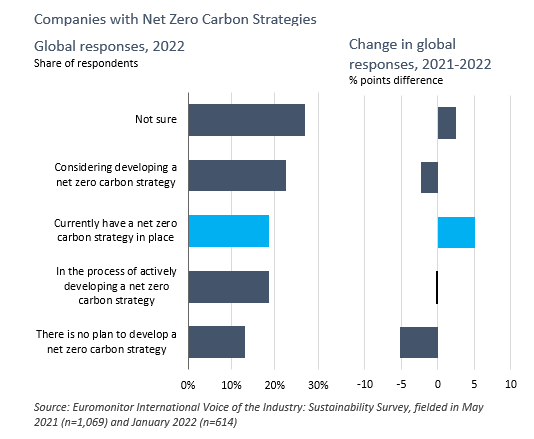

Despite consensus among professionals that climate action is important for their businesses, 82% of responses, according to Euromonitor International’s Voice of the Industry: Sustainability Survey, fielded January 2022 (n=631), still struggle to implement net zero strategies. Yet, as stakeholders’ pressures for climate action increase, mainly driven by CEOs, competitors, governments and consumers, companies with a net zero carbon strategy in place grew by five percentage points in the 2021/22 period, according to Euromonitor International’s Voice of the Industry: Sustainability Survey, fielded May 2021 (n=1,069) and January 2022. (n=614). However, adoption remains low, as in 2022, only 19% of respondents mentioned that their companies currently have a net zero strategy in place and over a quarter reported a lack of knowledge about whether their company has a net zero strategy or not.

How can net zero strategies unlock market potential?

To remain competitive, companies are already planning to invest in offsetting carbon emissions and developing low carbon products, with 34% and 38% of responses respectively, according to Euromonitor International’s Voice of the Industry: Sustainability Survey, fielded January 2022 (n=617). Product claims are gaining momentum as an effective way to demonstrate real commitment through certified and trustworthy actions, and carbon claims are no exception, as 57% of global professionals mentioned their companies plan to invest in products with low carbon/carbon neutral claims in the next five years.

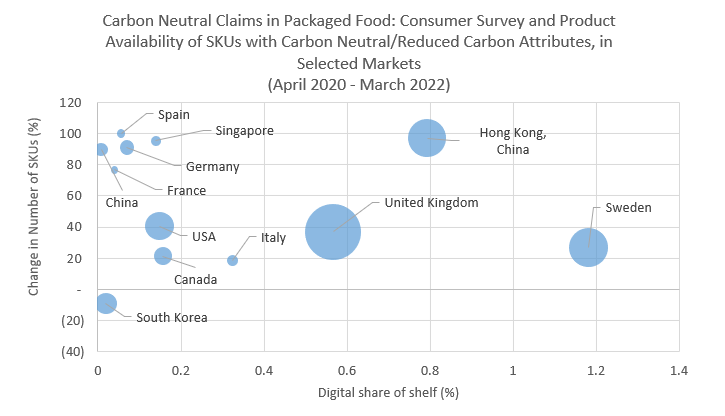

To seize opportunities, companies need to rely on data-driven insights to make effective decisions on where to play and how to win with specific claims. Through Euromonitor International’s web-scraping tool, VIA, the company can track SKUs, with and without sustainability claims, across different categories and countries in more than 1,500 retailers. The following chart shows how the digital offer of carbon neutral claims has evolved in the Packaged Food industry from April 2020 to March 2022 in selected countries.

Note: Bubble size in the number of SKUs with Carbon Neutral claims

It is clear that this is still a very niche segment as the higher digital share of shelf is just 1.2% in Sweden, while most countries have less than 0.5%, so there is plenty of room for positioning products with these claims in Packaged Food in all selected countries. Furthermore, the top left area of the chart shows the countries with the fastest increase in the number of SKUs with these types of claims. Spain, Hong Kong, Singapore and Germany are some of the countries where companies have started to disrupt by launching products with carbon neutral/reduced carbon claims.

Finally, with the uptake of stricter climate regulations such as carbon pricing spreading globally, companies that do not consider sustainability in the long term will lose ground as the costs of inaction will outweigh the costs of being proactive. In fact, The Global Commission on Adaptation estimates that investing USD1.8 trillion from 2020 to 2030 could generate USD7.1 trillion in total net benefits in areas such as early warning systems, climate-resilient infrastructure, improved dryland agriculture crop production and more resilient water resources.

For further insights into global sustainability strategies and challenges, visit Euromonitor International’s Sustainability insights page, The Rising Importance of Sustainability Strategies article, or consider a bespoke consulting solution.